But what if God himself can be simulated, that is to say can be reduced to signs that constitute faith? Then the whole system becomes weightless, it is no longer anything but a gigantic simulacrum - not unreal, but simulacrum, that is to say never exchanged for the real, but exchanged for itself, in an uninterrupted circuit without reference or circumference.

Jean Baudrillard

The first major financial crash of my adult life was the 2008 economic crisis1. And the second major financial crash of my adult life is happening now inside a glass bottle. Bookending this long decade, they are two poles of the same narrative.

The 2008 crisis was in many ways precipitated similar to the crypto crisis today. There were assets bid up by each other based on a consensual hallucination, and when it turned out it wasn’t work the cloud the castles were built upon, the firms went under.

The 2022 crisis had assets bid up by each other based on a consensual hallucination, and when it turned out it wasn’t work the cloud the castles were built upon, the firms went under.

And they were both supposedly the consequence of the monetary policy that came before.

The 2008 crisis, when it hit, took down the 4th largest investment bank, market cap of like $60 Billion, several hedge funds, and effectively kneecapped the entire economy.

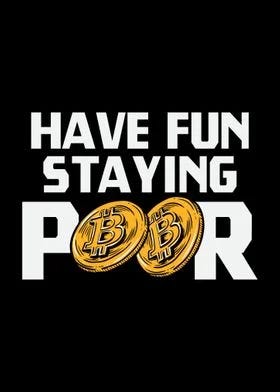

The 2022 crisis, when it hit, took down the 2nd largest exchange, valued at like $32 Billion, several hedge funds, and effectively had no real impact on the real economy.

The 2008 financial crisis began with cheap credit and horrible assets brought about by the cheap credit, like McMansions built on quicksand and dreams.

The 2022 crypto crisis came at the end of a decade of cheap credit, and people bought jpegs of badly drawn apes for $250k, which turned out to be surprisingly worthless.

In 2022, what was remarkable was the growth of the crypto market, from $20 billion a few years ago to $2.3 trillion and down, to the $1.2 trillion subprime mortgage market that emerged out of thin air by 2008.

As the Atlanta Fed wrote in 09:

Compared to anything seen since 1990, the size and rapidity of the decline is extraordinary. The widely quoted DJIA fell over half—51.1 percent—from a peak of 14,165 on October 9, 2007, to a low of 6,926 on March 5, 2009. While widely quoted, the Dow-Jones is an index of only thirty firms.

And the current crisis:

The tech-heavy Nasdaq 100 has dropped nearly 33 percent so far in 2022, the Dow Jones Industrial Average lost more than 20 percent while the world's best-known cryptocurrency, Bitcoin, shed nearly 60 percent of its value

As Byrne put it succintly:

Of all financial markets, crypto in its current state is the closest to a pure game. A crash in Solana isn't going to mean that factories don't get built or that new companies don't get funding; a spike in ethereum doesn't directly translate into real-world wealth creation, except in a very indirect way. Cryptoasset fundamentals are strongly tied to other crypto, and less to the rest of the economy.

The crises, seen from far enough away, blend eerily together.

The 2008 crisis came about because of cheap credit that made people make bad investments, which were made to look like good investments for a long while. The 2022 crisis came at the tail end of a long era of cheap credit which made people make bad investments, which most people thought were bad, but got shilled relentlessly by everyone till it blew up!

The 2008 crisis hit home values, and the financial sector, which directly hit the actual economy and ground it to a halt. The 2022 crisis hit asset prices, especially in the technology sector, and while the actual economy is reeling from inflation the crash itself didn’t really have an impact.

The core speculation in 2008 was around the incredible abstractions of various Asset Backed Securities, like packages of mortgages sliced and diced to fit just so. The core asset in 2022 was, in crypto, various tokens that might or might not have actual jobs to do, but mostly sat in balance sheets and pretended to be worth a lot of money so fraudsters could take out loans.

The 2022 crisis might actually see some folks head off to jail, unlike 2008.

So in 2008 bad real assets underwritten due to cheap credit, held and assessed shoddily, almost took down the real economy, in 2022 bad fake assets created due to cheap credit, held and assessed prudently, are almost taking down the fake economy.

Both crashes demolished people’s belief in that entire asset class, the ability of our “elites” to actively help the retail traders, the belief that the system is rigged, and the absolute certainty that something ought to be done.

What’s more, the crashes are also sparking remarkably similar regulatory responses!

In a final note of reflexivity, the 2008 crash birthed Bitcoin.

Satoshi created 50 Bitcoins with the very first transaction on the blockchain at 18:15:05 hours on 3 January 2009.

I wonder what the 2022 crypto crash will birth!

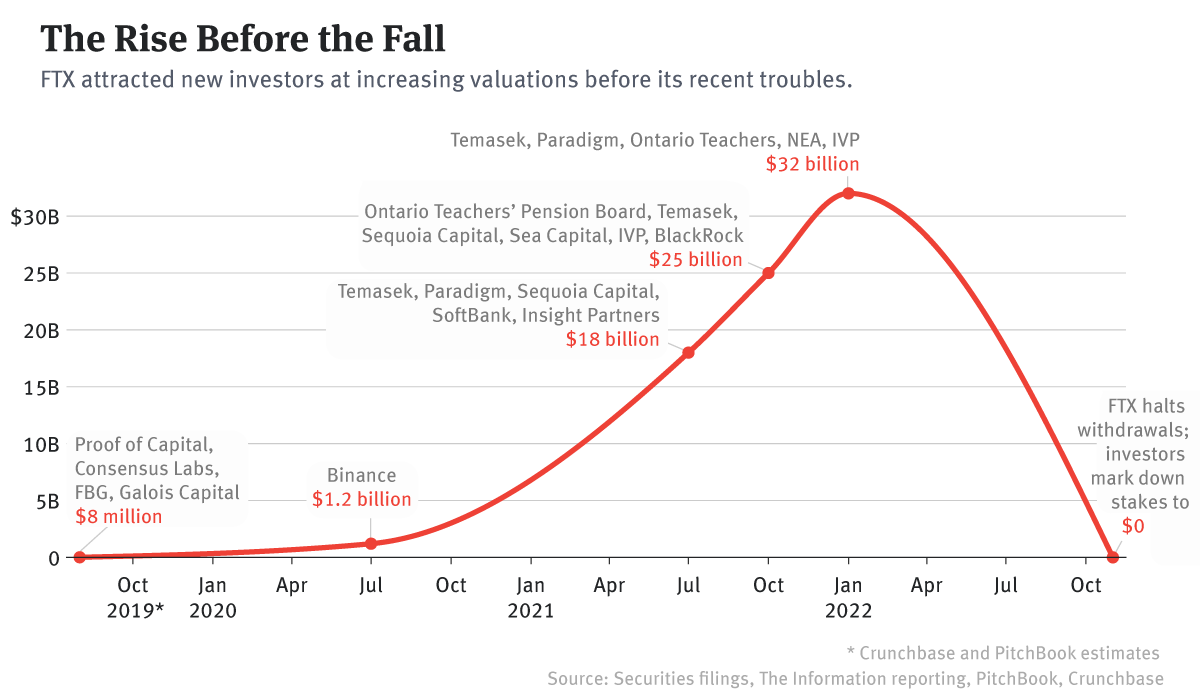

The normal reaction to much of the 2022 crash was that it’s a) only to be expected, and b) people are suckers for having fallen for it. An example:

Did anyone ever ask why hordes of mum-and-pop retail investors were wiring money to a shady entity called 'West Realm Shires Services Ltd' just so that they could become an unsecured creditor to a Bahamanian shell company to purchase derivatives of completely abstract financial assets whose only demand is driven by popular sentiment about a meme of a talking dog?

Sounds obvious and infantalising when you put it like that, but its important to note that the crashes are eerily similar. The incentives are all the same.

There is the perception created of a large number of “risk free” assets people should buy in order to secure their financial future

These assets are opaque or run counter to common sense, but those selling it are very sure that you should do it. In 2008 it was about why you needed to buy another mansion or two more condos with no payment down. In 2022 it was about getting 20% risk free yield on Anchor.

Whether its the innards of a squared CDO or the specifics of yield farming a receipt you got for staking your ETH, the mechanics of most of the transactions were so complex

When the rest of the world are getting richer, even if on paper, while you’re struggling to make rent, its natural to get tempted by a flashy advertisement whether that’s from a mortgage broker in a suit saying “no don’t worry you don’t need to put anything down” or “hey I’m Tom Brady, trust me” or even “hey I’m a billionaire from Facebook, and trust the process as I sell these zero revenue companies with a one page bullet point list to the public market”

There is tremendous pressure, overt and covert, that pushes every individual and every corporation to stretch, bend and quietly break any rules they can see, both said and unsaid, to try and eke out gains so they don’t get left behind. Because any individual who doesn’t take advantage of it is derided publicly.

The egregore is hungry for speed and scale: it wants to expand as quickly as possible. It encourages leverage, taking on excessive debt, increases propensity to believe in a far better future, and makes both the farsighted and the unscrupulous salesfolk seem like prophets.

What are the odds that people will make smart decisions about money if they don’t need to make smart decisions—if they can get rich making dumb decisions? The incentives on Wall Street were all wrong; they’re still all wrong.

One note I’d make is that every market crash in my lifetime, and my dad’s lifetime for that matter, has had people who wanted to be the Warren Buffett of that crash. Almost exclusively the Warren Buffett of that crash was Warren Buffett and the wannabe-Warren Buffetts usually quietly recede into the background pretty quickly thereafter, almost entirely because unlike Warren Buffett they wanted to get rich immediately rather than be an incredibly wealthy septuagenarian2.

We're really good at anthropomorphizing the world and its sundry phenomena around us. It’s one of the human superpowers. Whether it's corporations as persons, comparing the government budget to a household, ascribing personalities to countries and cultures and more.

None of this is true of course. Maybe painting at a broad swath it seems true, occasionally, but only because pattern recognition is do hard wired into our brains that we see it everywhere. Apophenia is our birthright.

The links between these two crises also show the shape of one of the egregores we live under. And one of them is this: a collective belief that by choosing whom to listen to carefully, and doing your own version of “research”, you can create a better future for yourself.

Much as Harry Potter acts as wish fulfillment for kids who want to believe they’re special because of who they are, instead of what they do, this is also fantasy that guides our behaviour in the collective. We will fall for mania, we will believe those we shouldn’t. Unless strictly gatekept, and sometimes even then. Our need to believe in our individual manifest destiny is far stronger than common sense.

What else? We can see the spread of this mania, like a contagious disease, as it transmits from person to person. Including superspreaders who pump it relentlessly, cheerleaders who hype it up, and naysayers who are collectively pointed to as those with no imagination, the muggles.

The benefit of crashes is that they act as societal coordination mechanisms to reset our collective expectations on what exactly our idea of the future ought to be. The move to cashflow generating assets instead of money-losing assets isn’t just being short-term greedy, it’s the egregore deciding that its overextended, and need to reset in terms of where we put our efforts.

Both crashes brought to bear the level to which the assets that were held and traded were smoke and mirrors, with the conclusion that the assets need to be linked to the real world in a much more direct manner.

The egregore however is the same. It relies on people making risky trades to get increased yield compared to “safe” assets, and taking on more loans than they should to do this, and getting caught without their pants once the tide went out.

Its like we set up a parallel financial world inside a beautiful glass bottle, one which does all the things you’d want to see, to understand how traders thought and people invested and scams ran and fraud perpetrated. It shows the disparity between the “real” economy and the financialised economy. It shows the way a high disparity society reacts to the markets.

There is one major difference though, which I want to highlight, lest this become a sermon. Which is the speed and isolation of crypto economy, which is actually interesting. It has, in the span of half a decade, created a parallel financial world that:

Speedran the days of wildcat banks like in the 1800s, who issued their own currencies, had shady reserves, and went under

Speedran frauds entirely built on hot air, like Luna and Terra

Speedran related-party-transaction frauds like FTX and Alameda

Speedran a truly incredible number of hacks and rug-pulls

What this means is that it has also created a perfect arena for us to learn how the financial sector actually functions, if only by using the on-chain information as a sort of forensic lens.

And so we should leave the system-in-a-bottle well enough alone and learn as much as we can from this natural experiment as we can. And if the genie in the bottle starts to actually touch the real world, sure then we can step in.

So maybe its good that crypto is actually speedrunning financial history. Economists have spent decades arguing about path dependency in events, and therefore its good to see some crises are just features of the landscape. And once they hit like sensible regulations and a central bank with deposit insurance it might actually become usable by normal people.

As the man said.

The line between gambling and investing is artificial and thin. The soundest investment has the defining trait of a bet (you losing all of your money in hopes of making a bit more), and the wildest speculation has the salient characteristic of an investment (you might get your money back with interest). Maybe the best definition of “investing” is “gambling with the odds in your favor.”

I tried starting a company just after Lehman collapsed, because I didn’t know what an economic crisis actually meant. That quickly became rather clear.

Which is an impulse I totally get.

Agreed on the long, slow game. Technically right now Buffett is a nonagenarian, not sept!

No one would much remember the 2008 crash if the Bernanke-Yellen Fed had kept even inflation expectations firmly on target, not to mention its employment mandate. 1929 Fed => Hitler; 2008 Fed =>Trump.