Mind the Gap

from empire to umpire

I wrote a book on AI development, exploring how it works, its history, and its future. Order it here, ideally in triplicate!

There go my people, I must find out where they are going so I can lead them.

Alexandre Auguste Ledru-Rollin.

Sometimes, when you look at things, the UK feels like it’s in a Mexican standoff with itself. While still sitting on a goldmine, it feels stuck as a fly in self-created amber.

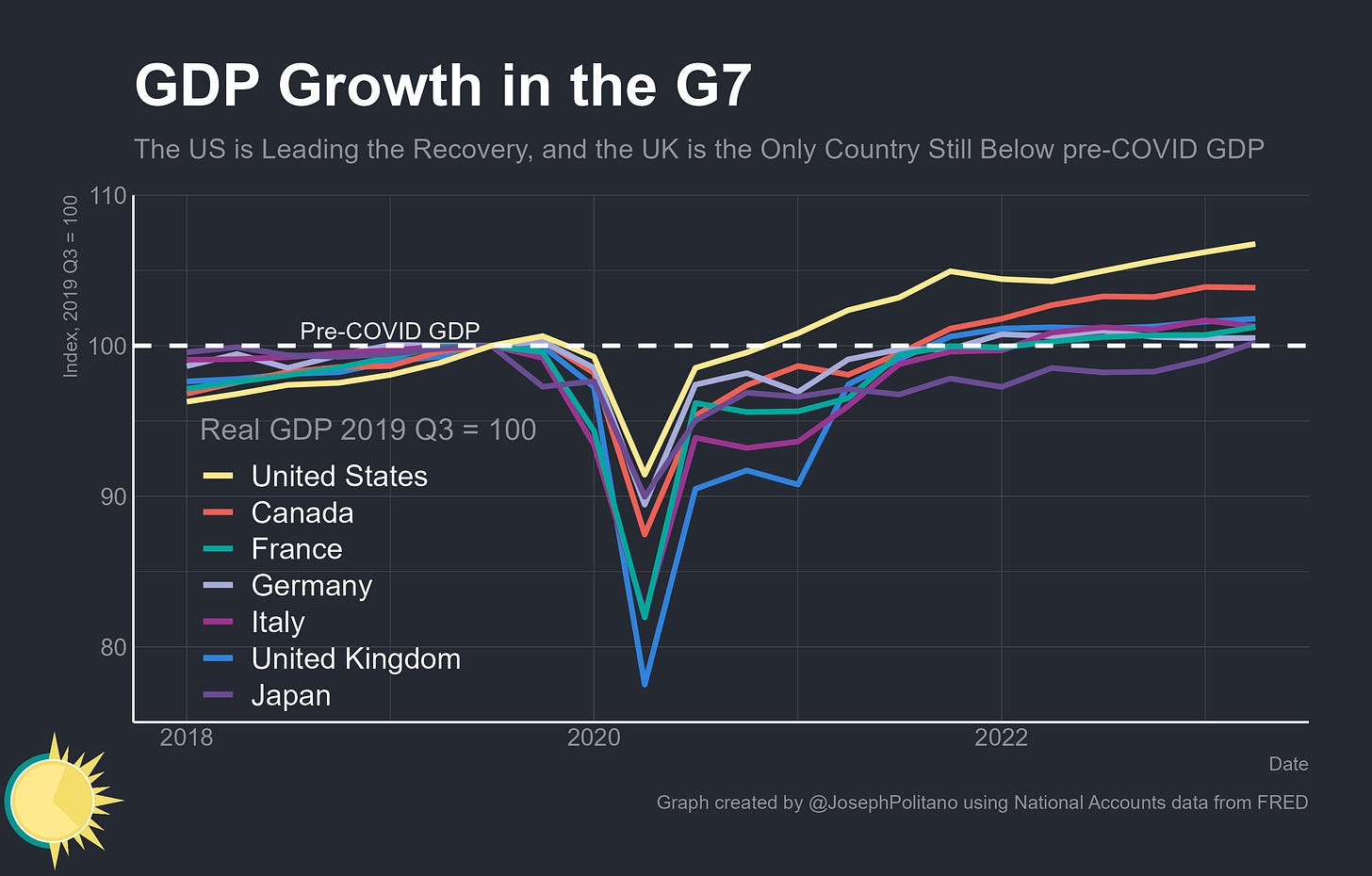

After starting to diverge from the US around the time of the Great Financial Crisis, it now lags further behind in productivity, in GDP and GDP growth. The average American is now almost 40% wealthier, almost entirely due to being more productive. Slovenia is overtaking Britain now in productivity and even much maligned Poland is going to do so in the next decade. The UK still lags behind where it should’ve been before the Covid crisis, the only large Western country to have this distinction. And in terms of household wealth or just sheer ability to build it lags behind seemingly every other country you might choose as a comparison.

Even the Bank of England are resigned to the fact that we will face a large trough of economic activity despite raising interest rates and getting inflation under control and increasing the unemployment rate.

UK GDP is expected to be flat over the first half of this year, although underlying output, excluding the estimated impact of strikes and an extra bank holiday, is projected to grow modestly.

….

Although there are indications that the labour market has started to loosen, it is expected to remain tighter than in the February Report in the near term. The unemployment rate is now projected to remain below 4% until the end of 2024, before rising over the second half of the forecast period to around 4½%.

It seems Britain is standing still while the rest of the world is sprinting ahead.

Quoting Joseph Politano:

British GDP per capita remains ever so slightly below the pre-pandemic peak, and the UK is still the only G7 member whose employment rates have not recovered to 2019 levels.

It has tried borrowing more, which didn’t seem to get anywhere, especially after the Covid crisis, but it did ensure the UK has to pay some of the highest rates to borrow. Higher than Greece. UK also tried austerity, cutting spending and trying to shore up public finances, but turned out everyone disagrees rather vehemently on what to cut but are united in the belief that what others think should be cut is wrong.

The consumption basket is flat in real terms, manufacturing is down a lot, energy prices are high, food prices are higher, and services, the mainstay of the economy, is flat. All of this is exacerbated by the problems from lack of housing, where UK builds less units than countries and states a third its size, and ends up with the median renter spending close to 40% of their income on rent.

The culprit many point to is the lack of housing, which the UK definitely has. Though they also are quite happy blaming the bankers, or at least the central bankers, who kept the rates low enough that everyone could be happy with much higher prices all around.

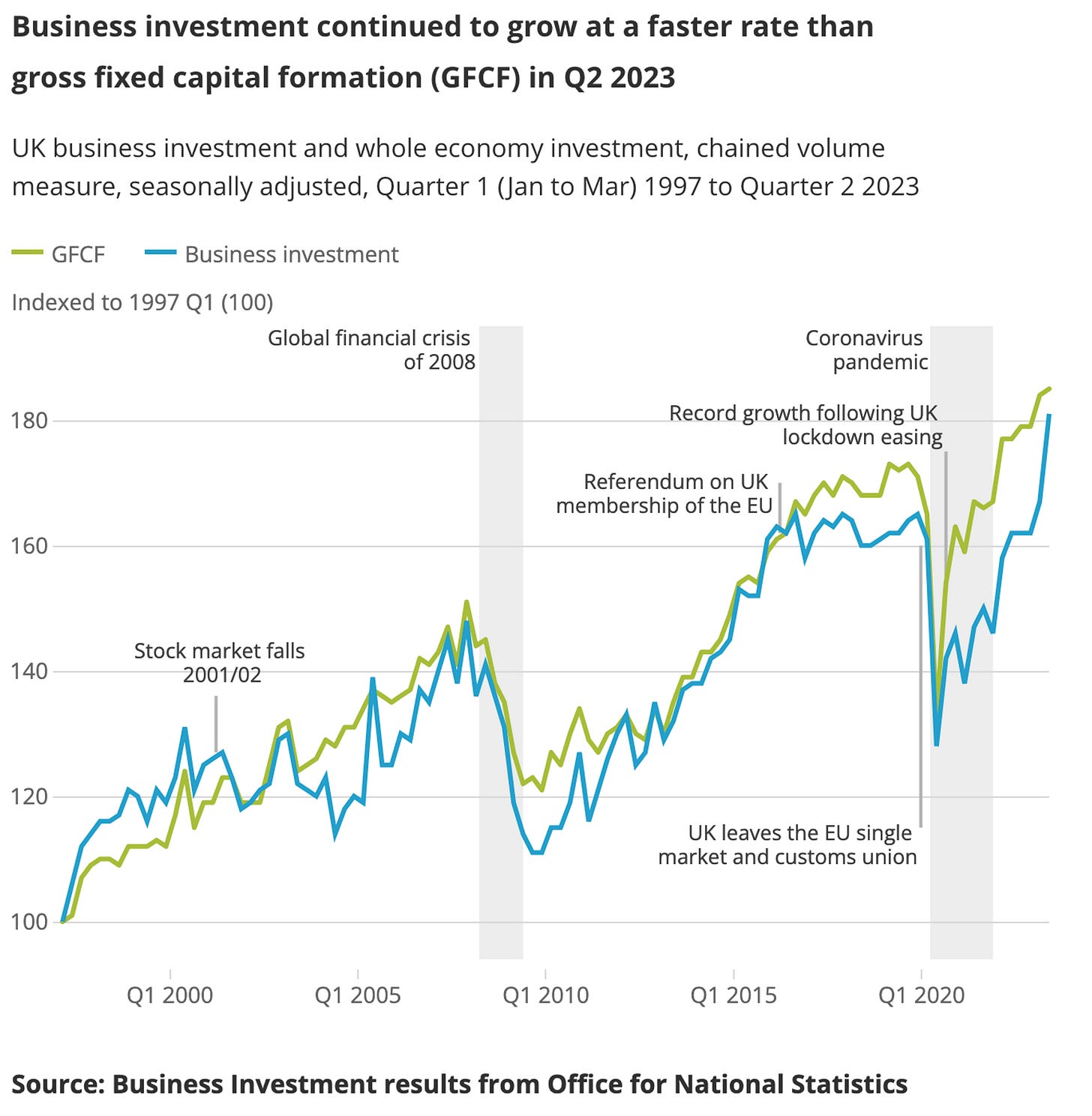

And to make matters worse the way ahead is shrouded in shadows, since internally almost no policy actually gets enough backing to get implemented. It should invest more, almost everyone agrees, but they disagree about both what to invest in and where to invest it. The NHS is perilously close to 50% of government spending and seems to keep rising, even as it both stays the crown jewel and the bit everyone is most regularly upset at.

And last but not least, most of the economic growth comes from London, or more broadly the Southeast, which serves to heighten the political problems internally that stops from there being an active policy to pursue. But then jobs outnumber people, which is why people move to London, but people outnumber homes, which is why home prices are so high, creating an uneasy equilibrium.

There is a strain of argument that it’s not just the housing supply that causes these issues, because there are 1.1 million more homes than households in the UK, which itself doubled in the previous thirty years. Even in London there’s 7.5% more homes than households. Turns out some people really love owning homes.

But homes aren’t easily fungible, unlike other financial assets. The home we purchase is linked to schools, with our neighbours, with friends and family, ability to go easily to work, and therefore having more homes in Brent isn’t going to help someone whose daughter goes to school in Clapham. So the only other institutional beneficiaries are the banks, as the unpaid mortgage debt reaches close to £1.5 trillion, or half of the GDP.

Will the existence, somewhat socially accepted, of remote work mean more people will move to the Northeast and live in lovely Durham, while “working in London”? We haven’t seen much movement but it’s not impossible. There are folks who live in Oxford and commute down once a week, and this is a more extreme version of that.

Which was the dream behind creating stronger connection corridors for people to move around the country faster. Namely the HS2 rail link, which was meant to work as a capillary bringing prosperity up from London and the Southeast to the north. But that's been scrapped now, half built, at double the budget, to save money.

And saving money is important. The cost of servicing debt is now at 3.8% of GDP, the highest since 1982. Shored up with strong words and stout hearts the UK has been trying to make a go of it in the post-Brexit reality, however the ability to consistently get in its own way is making this harder than it ought to be.

The debt by the way is also a problem because the UK has roughly a quarter of their debt linked to inflation. This worked pretty well for the last decade, but not so much these days. Since the BoE also pays interest on the central bank reserves, while making money through bonds bought through QE, it also has been hit with a loss from a rising bank rate! Not a good trade for the Treasury it turns out when inflation is high.

Recently even Labour, despite being out of power for more than a decade and still being blamed for much of what ails the country, suggested a £28Bn investment into green projects, only to row it back because they have to be seen as responsible.

To get out of it the UK needs to recognise that it does have advantages still, globally important ones. While this does get said quite often in public speeches, the actions somehow belie the belief, and are often timid.

The closest to an unalloyed good was where Prime Minister Rishi Sunak, juggling his inner hope of finding a silver bullet to relieve UK’s malaise and love for technology, held meetings with the dozens of AI leaders recently to retake the UK’s central role in the world of cutting edge technology. The amount committed itself seems too small, comparable to one round of financing that an individual company does, than what a leading nation in the G7 should be aiming for, but it’s a very good start.

It really would be great to regain leadership on the world stage. And also to take advantage of the brilliant benefits the island has. Because the reason the litany of complaints feels painful is the fact that the advantages outnumber the problems.

UK has an incredibly diverse and well educated workforce who are surprisingly global. Land in London having spent some time in the US, you will feel this as you walk around. The state response apparatus is actually less haphazard than you would imagine too, from hearing people complain. During Covid, they did dilly dally around shutdowns and openings, but they also sped up the vaccination program after Astrazeneca vaccine came out. A prescient move that saved millions of lives even as the country stuck its neck out in favour of a technological solution while the world relied on sociological factors.

Also, not to downplay it, London is one of the world’s best cities. A city that is simultaneously inviting, green, culturally sophisticated and diverse, with some of the best food you can find across almost every cuisine. Where else will you find bankers and poets and philosophers and investors and technologists all in the same gathering, under a folded Victorian roof that might not have the best draft protection but does have the aura of history.

These are not small advantages, these are incredible towering advantages that still exist no matter how dysfunctional the past few years of politics and policy have been. As the macro environment around the world starts to cool, and the cracks from Covid start to heal, it’s high time we started fixing things. A big part of the relative decline comes from self inflicted wounds and the fall of the pound.

Managed decline isn't an inevitability, but a policy choice, one that only became the default option because nobody wants to stick their neck out. Surely we can reverse this. It's not heart or brain that's lacking, it's courage, and it’s easier to fix.

Most interesting - the UK is still the only country batting at below its pre-COVID GDP, but is still doing better than France, Germany, Italy, and Japan overall.

If this is not a clear demonstration of the alpha/foundation the UK is presently squandering, on top of the value intangibles you describe (to which I would add the fact that the UK is, in a globally relative context, extremely politically stable, which may become more and more of an asset as the decades pass), I don't know what is.

Thanks for the piece!

Certainly absolute UK progress is not great. And the US has forged ahead since the GFC.

Yet, comparative data for Germany and France seems to paint a similar picture for GDP growth (as you’ve shown) and for discretionary income (see here - https://ronanmcgovern.com/are-we-too-negative-on-the-uk/)

Causes may vary, but the macro trends seem not to be uniquely a UK thing?

Is there other raw data that tells a different story?