Paul Graham wrote an article about wealth taxes. He tweeted about that article. And then the hordes descended on him.

So naturally this had the intended Streisand effect, and I read the article.

In it he assessed the impact a wealth tax would have on a (hypothetical yet all too real) startup founder. In his words:

Suppose you start a successful startup in your twenties, and then live for another 60 years. How much of your stock will a wealth tax consume?

And his answer is:

A wealth tax of 1% means you get to keep 99% of your stock each year. After 60 years the proportion of stock you'll have left will be .99^60, or .547. So a straight 1% wealth tax means the government will over the course of your life take 45% of your stock.

Now of course that's a crazy number. And the reason it's a crazy number is because, in Paul's words, "wealth tax compounds".

And Amjad Masad, the founder of Replit, looked at the data, and asked a rather pointed and poignant question:

The answer is no, I think, for me anyway. But that's a kneejerk reaction, so let's try and examine the controversy couple levels deeper than 280 characters.

Checking the math

So first, yes of course the math is correct. Spreadsheet here.

The key is that the tax is being taken out of the same pocket of money every year. See below, in pretty colours, what happens to the multiple on wealth over 60 years.

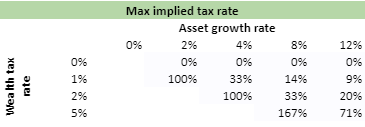

The "Asset growth rate" here is a measure of the yearly growth rate of the assets that are being taxed. The "Wealth tax rate" is relatively self explanatory.

Secondly, Paul says that even in a scenario where the assets grow at 8%, the government takes 65% of the gains (at a 2% wealth tax rate). This is because if you look at the difference between 0% wealth tax and 2% wealth tax on the 8% Asset growth rate column, you see that with the tax you "only" made a 3552% gain on your wealth, vs 10126% gain were there no tax. That's a difference of 65%.

Again, the math is correct. So that's a point in nobody's favour, since of course he's Paul Graham and of course I have Google spreadsheets, so the maths on multiplying a number 60 times should not be different.

But the issue is that in the typical nuance one expects from public debate, this became a question of whether or not Paul is correct. The issue isn't that he's incorrect, it's that the thought is incomplete. What he's calculated doesn't tell us enough about whether or not the wealth tax makes sense, just that compounding is the eighth wonder of the world.

Everything is cumulative

For one thing, if I'm earning $100k the government takes 30% of that as taxes and that's me losing out from my income. Separately if I trade, I pay capital gains tax on that too. Plus property taxes, which work pretty much similarly to the proposed wealth tax. In all those circumstances, compounding the taxes over 60 years would make anyone livid.

If I keep my wealth in my bank account, and my interest is taxed (as it is), then that's compounding too. Same with my dividends. And when I get a mortgage interest tax deduction, that's the inverse effect, where I'm getting an X^60 effect on whatever money I would've paid as interest.

Basically, I'm suggesting here that multiplying anything 60 times gets you a really large number, so perhaps getting a high emotional valence from a large number isn't particularly useful.

What is a wealth tax anyway?

One way I assessed is to look at the scenario that Paul painted, which is a 2% wealth tax and a 8% annual return on assets, to compute back an "implied tax rate" on the extra wealth that one makes every year.

This is because Paul suggests the issue is that the government dips into the same money pocket again and again, which is obviously silly and counterproductive. But it's also worth bearing in mind that very similar arguments also exist against capital gains tax.

For instance, if you work a lot, pay income tax, and then invest your savings in Apple. When Apple pays you a nice sweet dividend, that's coming from post-tax money that you've invested. So to ask you to pay tax on it again is a little naughty. And yet, we do it all the time. So taxing something multiple times, in and of itself, doesn't seem to be particularly problematic, since we already do it.

But in any case, since money is fungible, let's see what happens when we make the tax dip into a "new" pocket which we can call "delta wealth" that's been added in each period.

Here it seems like there is indeed a (progressive) large-ish tax rate being applied to new capital gains, and the tax rate actually decreases as you increase your returns.

So the calculus changes slightly, as does the rhetoric, from a wealth tax to become a capital gains tax that increases if you don't make more money. Leaving the implications aside for a moment, that also doesn't seem insane right off the bat.

There's another extremely interesting aspect to thinking of this as a progressive capital gains implied tax rate. The implied tax rate curve changes dramatically based on how your actual returns change vs the wealth tax rate. For Paul's preferred 2% tax and 8% returns scenario, the maximum implied tax rate is 33.3%. And it only reaches the max rate as you approach becoming a multi-billionaire, so fret not multi-millionaires, you got some time.

Other interesting notes on this analysis:

Whenever the asset growth rate is lower than the wealth tax rate, long as the assets are still growing you end up asymptotically hitting a point where your wealth basically doesn't change.

Whenever the asset growth rate and wealth tax rate are exactly the same, you end up growing the wealth by the same dollar amount, equal to the threshold amount X the tax rate

As long as the asset growth rate is 2x the wealth tax rate, the eventual capital gains implied tax rate is going to be 100%. If it's 3x, then the max implied tax rate will be 50%.

Is this a realistic scenario?

Even though the math is correct, it doesn't tell us much about the real world akin to what Paul is trying to tell us. To me this is why the hordes descend. Lot of it is misunderstanding and a fair bit of mood affiliation (on both sides, both sides), but a lot of it is also because simple excel models rarely work in reality.

Paul's first assessment holds true under the following conditions (which he notes in a parenthesis)

The assets don't grow

There's no slippage in analysis and collection of the tax

Neither of those are actual real things we can believe in the real world. But Paul also argues in his second assessment that even if you assume the assets grow, you'll still get a compounding effect in the cut that the government takes. This is accurate - as the right hand columns in the data table shows above.

But it feels different when you ask if someone is willing to give up 2% of their marginal assets over $50m vs 65% of all their gains over 60 years. Politicians often quote 10 year larger numbers when they want to make something seem bigger, and annual numbers when they want impact to seem small. Sadly, Paul's playing the same game.

And how easy will this be to do?

For example, the proposed wealth tax from Senator Sanders was:

Sen. Sanders proposed his version of a wealth tax plan: a 1 percent tax on wealth above $32 million for married couples ($16 million for singles) that increases to 8 percent for wealthier households. Net worth for joint filers between $50 million to $250 million would be taxed at 2 percent, $250 to $500 million at 3 percent, $500 million to $1 billion at 4 percent, $1 billion to $2.5 billion at 5 percent, $2.5 billion to $5 billion at 6 percent, $5 billion to $10 billion at 7 percent, and 8 percent on net wealth over $10 billion.

The calculation seems quite complicated. Even the brackets that Sanders identified is complex enough to make your head spin, since it's not standing in isolation, but depends on you accurately measuring the wealth, then measuring every other tax you need to pay as well, and then adding on this layer. And the reason it's complex is because you don't want something to be overly regressive on the lower threshold, which naturally has more people, but also because assets grow differently based on different wealth brackets.

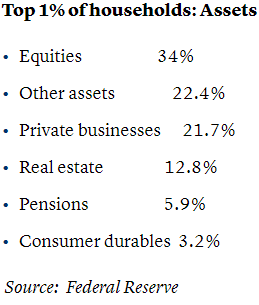

To note, below is the asset breakdown of household sizes in the US. So at least a meaningful portion of the assets held by those richie riches would be in illiquid securities. It’d be like asking Adam Neumann to pay taxes on his We shares.

Once you get past all those hurdles, you end up with the hurdle that you need to somehow figure out what someone's assets are worth at any given point in the year anyway. It's hard enough even for illiquid assets like property, let alone the rest. To quote:

Economists Emmanuel Saez and Gabriel Zucman, who have consulted with presidential candidates on their tax plans, define net wealth as financial and nonfinancial assets at their market prices, net of debts. Financial assets include corporate equity, private business assets, and other fixed income assets, such as liquid assets and deposits, bonds, and mutual funds. The nonfinancial assets include real estate properties, land, and buildings.

This seems ... hard.

So should we do it?

Here's where I betray my proletariat roots. I'm still kind of in favour of trying it. Mostly because:

It's a worthwhile experiment, even at a small scale, and we need more experiments in public policy rather than random deontological arguments without data, so I'm in favour of trying it

It's only for incremental amounts over $50 million in assets. $50m is not a median expectation amongst anyone. It's a massive payout, as it was for most of the world for most of human history! For context, this is 1000x the mean income. That's a lot.

I'm not at all convinced it will "destroy the US and entrepreneurial economy", definitely not in the next decade, because there have been plenty of tax hijinks in the past few decades, and little has changed with respect to the attraction for budding entrepreneurs who wanted to come to the US or pushing them away. Also, a) where will they go, and b) this isn't the biggest driver for people to start companies anyway

It's, in the end, a form of (weirdly stated) additional capital gains plus property tax which affects c.100k people

If it works, hopefully the resultant bureaucracy and info gathering admin will make the rest of the federal apparatus (like giving people state aid, or pandemic relief cheques) easier to do

(caveat: I won't be affected. So you can decide if that makes me more or less objective)

See the thing is, tax is like a SaaS fee you pay for using the services provided by a country. So if someone is asking for 30% of all your revenues, then you can either say foul, or you can just pay uncle Sam (or Apple). And progressive taxes are like value-based pricing, so it makes sense that those that benefit the most from things like a stable economic environment and rule of law would have to pay more.

But that's not to say it's a slam dunk. There are some fantastic arguments against it, which really don't seem to get the facetime they deserve:

It's an enormous administrative pain in the ass. In fact, the work that's been done so far suggest that wealth taxes that's been adopted has had decidedly mixed effects.

In the OECD data, the countries that collected revenues from net wealth taxes on individuals in 2019 are Colombia, France, Norway, Spain, and Switzerland. Revenues from net wealth taxes made up 3.79 percent of total tax revenues in Switzerland in 2019 but just 0.19 percent of revenues in France. Among those five OECD countries collecting revenues from net wealth taxes, revenues made up just 1.2 percent of total revenues on average in 2019.

France’s net wealth tax was repealed in 2018 and replaced with a wealth tax on real property. Belgium introduced its own version of a net wealth tax in 2018, but that was struck down by the Belgian Constitutional Court in 2019. In 2020, legislation was introduced on a new version of a wealth tax for Belgium.

Even if you manage to make it work, I'm not sure increasing the complexity of the tax code further is particularly helpful. We already have enough types of taxes to file and follow, and I'm not sure why introducing a new one will help more than adjusting the existing ones.

Estimating the fair value of assets annually is incredibly difficult. I work in venture capital and if I have learnt one thing, it's that nobody knows how to value a company appropriately, and definitely not enough to make it taxable. This seems like great news for accountants and tax advisors, but nobody else!

It would create some even weirder incentives, in making the wealthy want to take higher (and wanton) risks with part of their income, since the higher the potential returns the lower the effective capital gains implied tax rate. I'm not sure whether this is something we want as a society either. Also, apart from megayacht manufacturers and Bitcoin, I'm not sure I can say who else will be a winner.

The companies will start figuring out fun games with annuities, deferred payments, loans with low interest rates that don't require paybacks, in-kind incentives on the corporate card, and other genius moves to shirk off the burden, and generally making IRS work for its money

Increasing taxes always has some marginal impact on how it affects the economy. Making making money less attractive means that less people might want to make more money. I don’t know what the outcome here is likely to be, except for directional economist handwaving, but that’s at least something to consider. If only so that Tyler doesn’t get upset.

Is it worth it for a measly $3 Trillion?

Coda

One of my biggest fears in life is doing my taxes. And not just because it's annoying and I am incredibly bad at doing administrative tasks. It's because there is the constant threat of "if you get this wrong, we might make your life hell and fine you and maybe send you to jail, which will entail even more paperwork". And then they ask you things like all your bank accounts and max balances and income from dividends and bank interest and put it all together to make me absolutely miserable.

Getting someone else to do it hasn't helped much either. Because they just ask me to find the things and send it to them, which seems inefficient and also worry inducing.

So when someone wants to introduce yet another tax I have to look at that and go, really? Is it not enough that our existing system is so byzantine that it literally gives people anxiety disorders?

Why not just change the wealth tax to be an additive capital gains tax with a floor? I'm not sure. Why not edit it to be activated upon transactions or transfer or sale or withdrawal or refinance? I'm not sure. Honestly it feels like the Senators started with "what phrase polls well" and worked back, rather than the other way around.

We seem to use our tax system as a key tool for social policy. It's as key today in 2020 as it was a half century ago. Tax policy is not just about raising revenue in an equitable fashion, it's also about implementing the social policies that the government wants for us as a society.

While that is fine tuned as a tool as any the government uses, perhaps there should be the occasional pruning of the complexity tree, rather than trying to fix the mess by adding more branches?

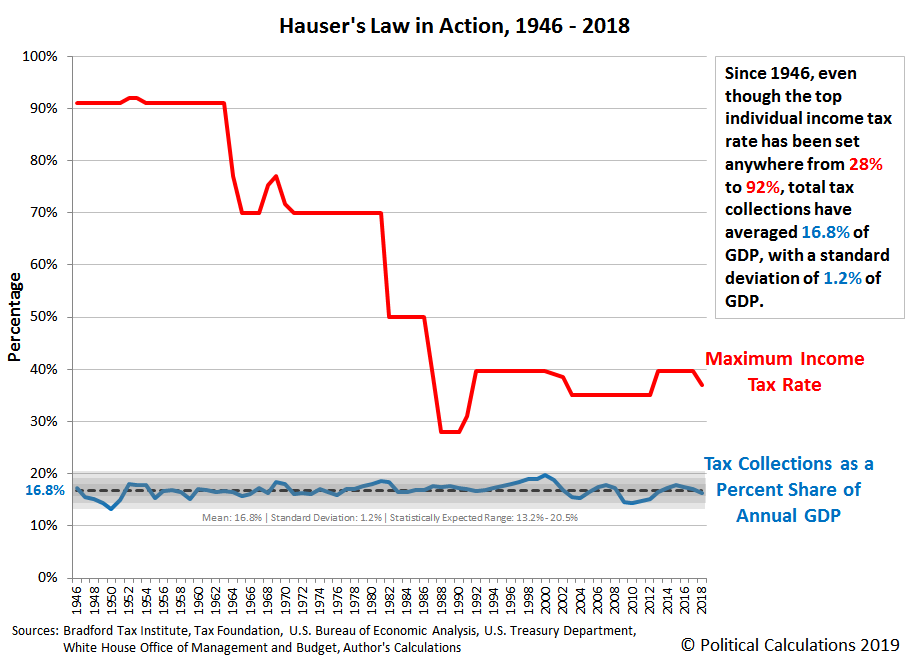

Mostly though, I'm reminded of the below fact, which is my favourite piece of data in all tax policy. I had looked at this before.

despite every change in individual tax rates, the total tax collections as a percentage of GDP seems to be extraordinarily stable. It's called Hauser's Law, and is one of the more counter-intuitive empirical results in economics

Another point that annoys me is that the government doesn't seem to know enough about the residents to just levy the tax? How does that happen? Can you imagine if AWS ran like the government? “Tell us at the end of the year how much compute you used, and make sure you report every API call and every byte stored, even if via a serverless function call.” And then pay up. And Bezos will have the right to audit you whenever he wants and make life hell, just to make you prove that you did what you say you did.

It's insane! And why, because you don't want government to know about you? They already do! It's just not useful to anyone sitting somewhere inside labyrinthine IT systems.

So come on government. Everyone thinks you suck anyway at doing most things. Please create a spreadsheet with 350 million rows, stop asking us for stupid pieces of information you already have, call social programs social programs rather than "something something tax rebates", and just stop messing with my head.

PS 1: Since the last couple paras brought more than a few emails my way, a few clarifications:

I don’t think the wealth tax is horrible per se, through some sort of inherent flaw in its very soul

I do think it’s been shown to be ineffectual and difficult to put into practice, as evidenced above

Which means I’m (very very lightly) in favour of trying it still - not because it’s amazing but because I think we need more experimentation with our governance anyway. Prior efforts in EU have ended with lighter versions, like land/ property tax, which would be a nice place to end up

I do think the government can be embarrassingly ineffectual at times, but using that as a reason to not fund it seems counterproductive. After all, we kind of need the government…

I think there’s merit to the Stubborn Attachments thesis (also mentioned by Stephen) that it might be better for us all if the more productive (billionaires) use capital than the less productive (government). But I think this is a false choice and has worse slippery-slope issues since we do need collective decisions to do things which have large average utility, not just large marginal utility. Especially since we don’t have a choice as to if we have a government, only its efficacy

Separate to the funding discussion, I think social policy should be separated from tax policy, as much as possible, rather than confusing the two, as that just muddies the waters

Everyone involved in the debate seems to have rather strong convictions about what actions are good and need to be encouraged and what are bad, and who is good and who is bad, pro government vs anti government, and more, all of which seems counterproductive if the goal is to design a good system.

PS 2: If anyone reading knows Paul I suspect he agrees with me on 75% of this article, though not its conclusions. I’d love to know…

Few notes:

1. Wealth-tax being ameliorated by growth will in principle make it negligible. Except for the one case when someone is down on his luck and losing money, i.e. the only case in which one really wants financial security, so it removes the very important "feeling" that people have about making money of "once I have this I will be secure" (of course, that feeling is fake, but many people get into the rat race for just that security high)

2. Wealth tax as a mechanism, to my naive understanding of economics, already exists via inflation and dividends/CGT. Since any significant amount of wealth is likely producing more wealth, quite a lot probably, 2-4-8-20-200% a year, taxes somewhere between 10 and 40%, that's a lot more than a wealth tax.

I think those 2 points alone are enough to argue against a wealth tax, but

3. Living and paying taxes in the US seems like a status symbol to me or a socio-cultural decision. It gets you a weak passport, a beyond 3rd world probability of being drafted, insanely high taxes with criminal charges for getting them wrong, no public services besides some roads (tbh, the roads are nice) ... oh, a government that hounds you for money even if you leave unless you wait 1 year and pay an administrative fee and potentially a divorce tax, then it will leave you alone (maybe).

On the other hand Andora, Malta, Romania, Montenegro, Bulgaira, Georiga and various Swiss Cantons are winking at you and offering:

* Taxes between 0-25% depending on profession and income levels

* Socialized everything (healthcare, pension, dentistry)

* Cheap (relative to US cities) housing

* Very strong passports

* De-facto (and in some cases de jure, arugably) it's no a crime (you can be fined, but not imprisoned or killed) to mess up your taxes

* Double taxation treaties with basically all countries imaginable (except the US)

(Some `*` don't apply to 1 or 2 places, e.g. low tax Swiss cantons and Lichtenstein are expensive in terms of housing)

I've tried to convince people making low 6 figures in the US (in remote-friendly jobs) to renounce its cruel taxes and come live in <the rest of the world> like literal kings, yet for some reason they prefer allocating 140k as: 70k tax, 20k insurances, 30k tiny metal cage in skyscraper, 20k takeout.

And I've failed to convince a-single-person. So I for one have come to disagree with the idea that people take any rational actions in regards to their tax environment, I'm sure you can make or break a society with taxes, but I think the process is much more subtle and I doubt anyone understands it.