<Note: This essay is also related to Strategy Decay, Understanding Wage Stagnation>

I

One big question we face in our world is why colleges are so damn expensive. Or maybe they should be asking why post-college salary bumps are comparatively so small, despite multiple papers justifying the returns to college as seemingly high! Considering I went three times and got three degrees, it only made sense to dive a bit deeper and see if I was an idiot.

For instance, the numbers clearly indicate that the average annual wages are definitely higher if you went to college, as per the New York Fed.

As for how much these costs have changed over time, the sticker price of a bachelor’s degree has increased sharply, more than tripling from about $4,600 per year in the 1970s to nearly $15,000 per year in 2013

This we know well. It's the classic issue of out of control costs in some sectors. Baumol is often evoked. But it's also not the whole story. When you go to college it's not just about the tuition. We need to analyse the other factors as well, including the world where you didn't go to college.

Helpfully, they look not only at the sticker price of the actual tuition, but also the opportunity costs associated with going to college.

And then they conclude:

Looking at the change in total costs over time, we see that the cost of a bachelor’s degree held fairly steady from the mid1970s up through the mid-1990s, then rose until the early 2000s before falling again shortly after the Great Recession.

This seems to say that yes, the sticker price is kind of high and crazy, but look at the opportunity costs of going and the answer becomes clearer.

When you put them together, this states, the return to going to college seems pretty steady, at least for the past few decades, and arguably increasing before then. These are rough estimates rather than actual fixed analyses, and doesn't include the inclusion of dropout risks, but it's still highly suggestive.

So far this seems like a rather straightforward economic justification for going to college. You have to pay more, but your opportunity cost is lower, so net-net of course you should go.

And naturally, this is an average, which means there are those in the distribution that this theory doesn't apply to. For example, this study looks at selection-adjusted NPV estimates for a bachelor's degree in the US and concludes:

for students at the lower end of the ability distribution and in some areas of study, a college degree may never be a good financial proposition

Which is about as self evident as a proposition gets, but it's still helpful to have some empirical and theoretical backing. It also gives us this beautiful and poignant example, yet again, of why you shouldn't study Education as your subject.

As that study shows, of course there are differences in which college degrees actually end up conferring much of the benefits, and there is a pecking order. To nobody's surprise, engineering seems to top the list. And again to nobody's surprise though deliciously ironic, Education is at the bottom of the list.

With tuition rising, wages falling, and many college graduates struggling to find good jobs, the value of a college degree may seem to be in doubt. However, these factors alone do not determine whether a college education is a good investment. Indeed, once the full set of costs and benefits is taken into account, investing in a college education still appears to be a wise economic decision for the average person.

This work applies internationally too, when looking at the impact of education on earnings in the UK, they also report an average return of 27% for those completing higher ed.

In fact, to help the poor student who is contemplating embarking on this wonderful journey to self fulfilment, the research also suggests that they need to be smart decision makers:

To make the best college investment, Oreopoulos and Petronijevic stress, prospective students must give careful consideration to selecting the institution itself, the major to follow, and the eventual occupation to pursue. For any particular program at a particular school, anticipated future labor market earnings, the likelihood of completion, the costs, and the value of any student debt must all be factored into the assessment.

It seems to take advantage of this large ROI opportunity, you also need to be a pretty savvy shopper, to understand and internalise a vast array of pretty complex variables, and homo economicus your way to a decision.

If you do end up looking at all these variables, deciding on the right course to study at the right university with the right financial backing, is that enough? What do you get to learn in university that creates this demand for you? A paper by David Deming from Harvard dictates it's actually the social and soft skills you pick up.

The labor market increasingly rewards social skills. Between 1980 and 2012, jobs requiring high levels of social interaction grew by nearly 12 percentage points as a share of the U.S. labor force. Math-intensive but less social jobs - including many STEM occupations - shrank by 3.3 percentage points over the same period. Employment and wage growth was particularly strong for jobs requiring high levels of both math skill and social skill

So when people complain about how they barely use anything they learnt in college in their "real lives", it's kind of true, but only re the technical skills they might have had drilled in. You're not going to learn trigonometry, but you'll learn a hell of a lot about how to convince your friend to let you cheat off her in trigonometry.

Putting it all together it turns out the reason that people still need to go to college and get their uplifted wages is because if they didn't, they would be in a much worse place. And what they get for going to college is to pick up the social skills that are necessary in today's workplace.

The flip side of the argument is rather strong too, and has the wealth of current public opinion behind it. A paper by Alan Ware starts:

The role played by educational credentials in British labour market recruitment changed radically during the mid‐twentieth century. Having higher or better credentials than others became a key determinant in selection for society's best‐paid jobs. The resulting race for them has had perverse effects. A large minority of graduates earn no more than non‐graduates or are in jobs for which they are ‘overeducated’. ... Not only is there resulting social waste but also social injustice; while education was understood previously as a means of breaking down barriers to social mobility, it now has the opposite effect.

He says the pressure on students to go to university is analogous to the "fraud" perpetrated by our ancestors when they stopped hunting and gathering and started the agricultural revolution. While the exact analogy might be overblown (and sounds insane), his theory is expounded to show that all the supposed gains we have are mostly just signalling. Employers feel like they can ask for more and more credentialing, which means employees end up getting degrees upon degrees, resulting in people way too overeducated for specific jobs, resulting in a social structure that's about at the same level of ossification as the ones several decades ago.

Another analysis of the worth of college degree when higher education expands from the American Sociological Review says:

The relative education hypothesis posits that when college degrees are rare, individuals with more education have less competition to enter highly-skilled occupations. When college degrees are more common, there may not be enough highly-skilled jobs to go around; some college-educated workers lose out to others and are pushed into less-skilled jobs. ... Higher-education expansion erodes the value of a college degree, and college-educated workers are at greater risk for underemployment in less cognitively demanding occupations.

However nice this sounds, this still isn't the full picture. Most of the ROI we're talking about seems to have been driven not by the wage increases post-college, as should be the case if college was actually worthwhile, but rather from the horrible position you'd find yourself in if you didn't go.

Why is this the case? The answer lies in the declining fortunes of those without a college degree—a key consideration in assessing the economic costs and benefits of obtaining a college degree. On the benefit side, although the wages of college educated workers have stagnated since the early 2000s—and even declined in the years since the Great Recession—the wages of high school graduates have also been falling. As a result, the college wage premium has remained near its all-time high. On the cost side, rising college tuition has largely been offset by the declining opportunity cost of attending school, which, again, is driven by the falling wages of high school graduates.

So what seems the answer thus far? You should go to college because not going is worse. If you go, you'll have to pay a heck of a lot in tuition and other expenses. So you better figure out a good way to get that money. And even armed with these facts, you better study something useful (not Education) lest you be left behind.

II

One key takeaway I have from the previous section is how functional the calculus is. Unlike what was the norm when I went to college, education seems a tertiary goal, with the primary and secondary goals being to get a decent job.

It's not, as liberal education wonks would have you believe, to teach you to think. The esoteric advice of "helping to form a network" still seems to be somewhat true, insofar as developing soft skills and social skills seem to go along with actually getting along with other humans, but again it seems like a means to an end.

The arguments all revolve around the decisions of which salary-maximising major to take (not Education), which colleges to choose, how to identify tuition reduction strategies through grants and more, how to use debt wisely, and more. It's the life equivalent of buying your first house, but with more paperwork and beer pong.

The new paper from Richmond Fed speaks to this delta rather vociferously. They analyse the fact that despite college wage premia remaining high, there doesn't seem to be a concomitant rise in enrolment and attainment. And their analysis for the reasons of this seems to lead them to the conclusion that this is due to "risks faced by the students". What risks? In this case it's the fact that "preparedness and financial resources substitute for one another." They conclude:

After all, well-prepared and well-resourced students face less risk and are better able to self-insure while poorer and less-well-prepared students are instead less likely to enroll.

The analysis here is that despite going to college having positive outcomes associated with it, people won't do it because:

If you're well prepared, the risk is lower, so most of you are going anyway - you're not going to see a further rise from this segment

If the payoff is delayed too much, then less students are likely to enroll

And if the wages go up in the non-college-worker category, including unskilled jobs like construction, this also deters college enrolment

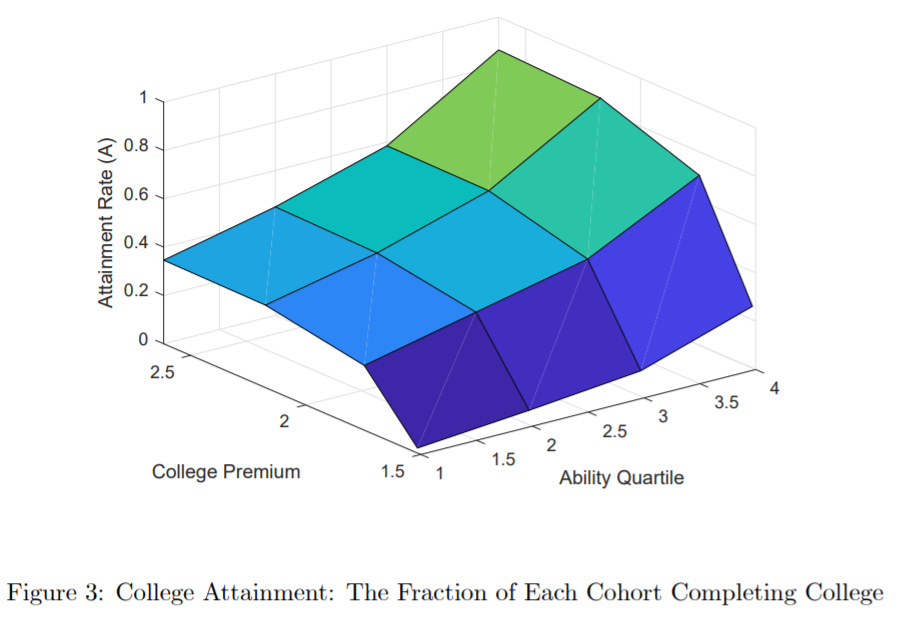

Which boils down to the above chart, which shows that if you have high ability and potential for high college premia, your enrolment rates will be high. However if you have high ability and the college premia isn't very high, then you can just as well skip college (low enrolment rates).

To see if the intuition holds true historically, perhaps it's worth casting an eye back to the college graduates of yore, and see what their life was like. Forbes reminisces:

Compare the cohorts born in the 1930s, 1950s, 1970s and 1980s. Look at white, non-Hispanic college graduates in each cohort compared with those without degrees. The college wealth advantages for the four decades are, respectively, 247%, 185%, 134%, and 42%.

See a trend? The wealth advantages do seem to be going in one direction. What this indicates is that the wealth differential has declined for more recent graduates.

The same analysis also is borne out by Ellen Shell in NYT, citing the Fed's work.

Since 2000, the growth in the wage gap between high school and college graduates has slowed to a halt; 25 percent of college graduates now earn no more than does the average high school graduate.

Which means that if this is even partially caused by actually going to college, the benefits it conferred have been slowly evaporating.

[Tim Bartik and Brad Hershbein] found that for Americans born into middle-class families, a college degree does appear to be a wise investment. Those in this group who received one earned 162 percent more over their careers than those who didn’t. But for those born into poverty, the results were far less impressive. College graduates born poor earned on average only slightly more than did high school graduates born middle class. ... By middle age, male college graduates raised in poverty were earning less than nondegree holders born into the middle class. The scholars conclude, “Individuals from poorer backgrounds may be encountering a glass ceiling that even a bachelor’s degree does not break.”

What could another reason be? They suggest that a change is that the cohort from the 1930s who attended college were probably already somewhat elite, and they came of age when less than 10% of adults had college degrees, which made it much easier to set themselves apart. Whether through signalling or actual skill acquisition, they became elite as well.

From Ellen's article comes the choice quote that underlines the grade inflation argument:

Why do employers demand a degree for jobs that don’t require them? Because they can.

III

When I was a student, if you had a degree, you had a job. If you didn't have a job, it's because you didn't want one.

Sir Ken Robinson

The inescapable conclusion from the pieces of research above is that college still could be useful, and might confer a financial and life advantage, provided you choose the right college, the right major and finance the price responsibly. Which is roughly tautological as far as I can tell.

While this is the case today but it wasn't always thus. Were you to grab a random high-schooler in the 30s or 50s or 70s or 90s and try to figure out if they should go to college, the answer would've been yes. A relatively unequivocal yes.

Do you see what this means? There was a clear and unambiguous strategy that worked for pretty much everyone who tried it for the longest time in history. No wonder it became a mainstay of moralising conservatives and freewheeling loosey goosey liberals and crept into government mandates, approaching a level of self satisfied smugness as the answer to all of societal evils.

This would be the equivalent of Sarah Constantin's analysis on money managers doing a few bare minimum things to push their returns above the median. But those returns diminish as more people use the strategies. There's nobody who gets an extra alpha boost from using Excel today.

I wrote about Strategy Decay before. The key insight was that we could have very well understood strategies that still have applicability, but the benefits of that will diminish over time as they are utilised by more people. While you might have "Win" strategies, which have outsized rewards, those diminish as they get more well known.

Which is exactly what's going on with the benefits of going to college. Soon they're just "Equalising" strategies, that help bring people up above the median.

While it's true that going to college pays dividends still, the fact that there are a whole lot more caveats attached to that statement over the past few decades is what you need to know about the trendline. What used to be a no-brainer isn't one anymore.

As people realised this was a path to success, almost everyone thought they could use this strategy too. The best option of course was still to go to the Ivies, the top elite schools, though the schools lower down the totem pole would still work to have the chance at a good life.

Which also explains why colleges are so damn expensive. Since the elite schools always have a supply-demand advantage, they have pricing power. And during the phase where going to college has positive outcomes for whomever chose to do it, the colleges had pricing power too.

(The Covid-19 pandemic, coming at the far end of a time when this strategy stopped paying dividends, throws into sharp relief how this has changed. The elite colleges still have pricing power, but as the demand side of the equation catches up to the fact that the strategy no longer works as well, the pricing power of the colleges lower down the pack disappears.)

And you start seeing new "strategies to win" emerge. Thiel Fellowships, On-Deck courses, building in public to get an audience, playing around with Replit. These are all outcomes of a phenomenon where, if you're not already elite or advantaged, you need to find a new strategy to push yourself up in life. You can't rely on "Equalising" strategies much anymore, you need your own "Win" strategies. And if you were already elite, some of the advantages these things give you - network, social skills and the smell of opportunity - would seem like things already eerily familiar to you.

So when my son gets of college age and he decides to go, or not to go, it won't be because it's a clear path to provide him a gilded path to success. It will be because he thinks it might be educational. To succeed in business or finance or arts or entrepreneurship, he'll need to find his own "Win" strategy.

So when we ask the question of whether it's still useful to go to college, the fact that the answer has become more nuanced is an indication that the benefits that it gave are now too diffuse. The Richmond Fed paper discusses this in the context of graduation rates, but the fact is that college today has become like high school before. You have to do it, but not because it'll give you all that much, but because without it you might be destitute. And even with it, going and doing well is not enough, you'll still need to hustle your way into finding other ways to actually start making a mark.

IV

So after all that, if you did decide to take the financial gamble and go to college, how feasible is it?

I had written before about the role that increasing demand in the form of applying to jobs had in understanding wage stagnation. It used to be the case that job applications and job posts had to find natural, local equilibria. But when staffing agencies started becoming popular and applications more streamlined, suddenly everyone applied to everything, and the job market suddenly seemed much more competitive.

The same thing applies to colleges too. I remember applying to 6 colleges at the end of my high school, putting me squarely at the bottom of my entire peer set. (Actually, it was 6 exams, some were for multiple colleges so the net's wider, still it was the lowest number). Most people applied to large numbers of colleges, and everyone is forced to become more selective!

The first implication is that nobody really needs to worry. If everyone is applying to everything and that's why the figures are all shooting up, then we're fine! All colleges can claim to be more selective than they actually are, and we'll just get a similar sorting done. The only casualty is the college admissions office, so who cares!

The second implication is that if this happens simultaneously with the realisation that going to college is more or less a very expensive rite of passage, then its utility becomes questionable. Because it mainly rewards doing well in a very particular rat-race. And when you succeed, your reward is to go get a six figure salary at Goldman Sachs where, similar to the Amazon warehouse employee, you might have to pee in a bottle.

For the first implication, the number of college graduates has increased steadily since 2000, as seen below. This is in sharp contrast to what was going on beforehand, where the trend was much flatter.

And for the second implication, it looks like despite the increase in number of college graduates however, there's a long way to go. The reason the strategy works even now, somewhat, is that fewer than 20% of 21-24yo have a college degree, according to EPI.

A different analysis, with a higher age level, indicates higher figures here, which indicates at least some folks get their degree later. There's clearly still a majority of people without degrees, but the gap doesn't seem as wide as suspected above.

While these figures have some room for error it's still a large white space, so the pressure is not decreasing anytime soon.

V

So what does this mean? Is the job market changing enough that this link between colleges and good jobs will be broken? Has something significant changed?

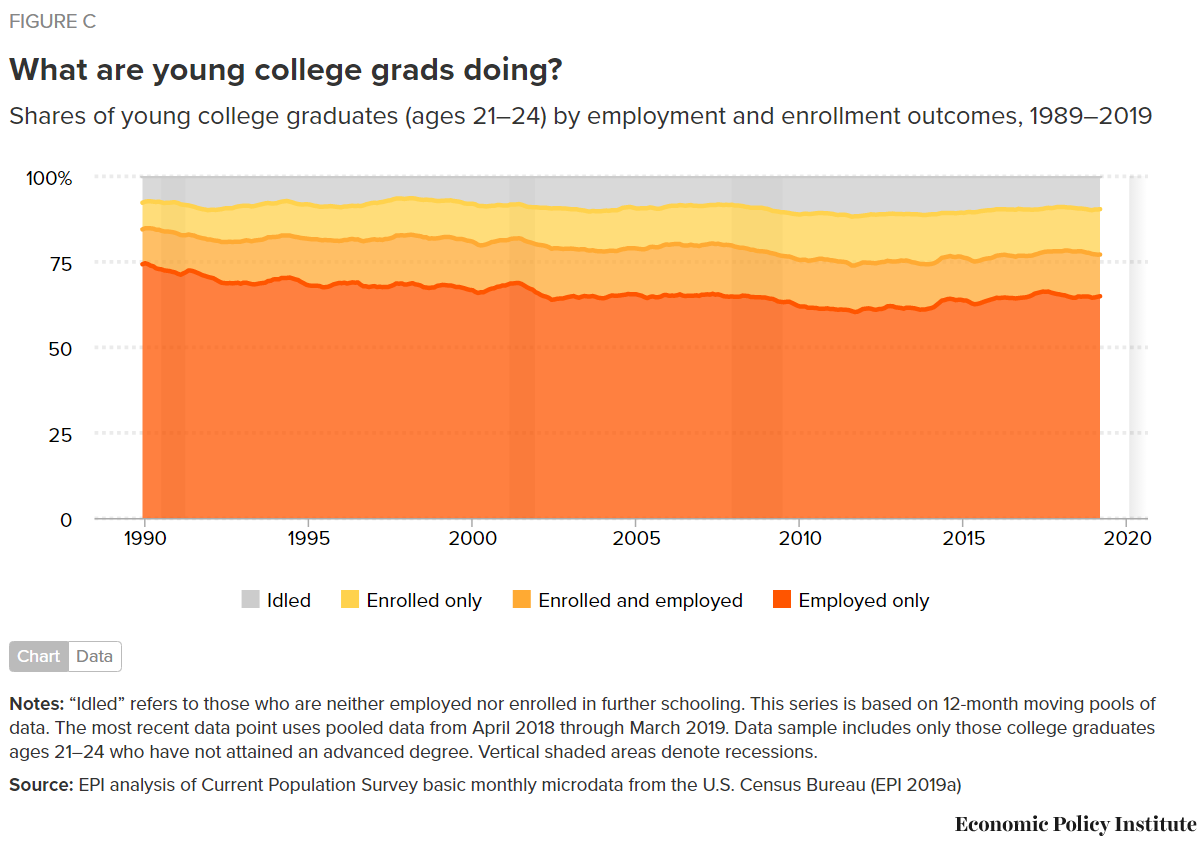

EPI data suggests that there is a small increase in the "Idled" category amongst young college grads. The chart isn't particularly clear, but the decrease amongst "Employed" is 7.4% between 1990 and 2020, which seems like a pretty significant delta.

Also, how good exactly are these jobs that the grads are employed in?

Not that great, since the underemployment rate is higher than at most points in the recent past.

And finally, does this change once you're no longer a "young college grad"? I.e., is there a time component to this that we're missing? Well, yes there is. For those who do a Bachelor's degree, there's a clear S-curve shape to their earnings, which tends to pick up later (as the paper also says, not for Education).

As the study notes:

At the same time, we find considerable variation across degree types and fields of study. Several vocational diplomas, certificates, and associate degrees are associated with higher earnings than bachelor's degrees in social science, liberal arts, and education.

One obvious reason this delta in employment with job and salary stats exists could be the major growth in the gig economy. Not just for Uber, but also for adjunct professors and tech employees. The argument has been made several times, for instance this article.

As of 2015, 54 million people were working as freelancers or independent contractors, and they’re estimated to earn 17% more per hour than traditional employees. It’s even projected that 60% of companies plan to hire more freelancers than full-time employees, with 45% expecting to increase hiring of freelancers by 30% or more by 2020.

Do the modern gig workers also need college degrees? It's unclear. Even if they're off to work for Google, who seems to hire more contractors than employees, the answer sounds like it would've been yes, at least until very recently. Otherwise, it's unclear. After all, even if you set up your own shop and want to go get your own clients, they'll still need to know you know something, and the shortcut of a college degree is hard to avoid.

So if you did think about the gig world as a viable career alternative, you might be well placed to go get that degree still. While Mark Zuckerberg and Bill Gates dropped out of Ivies to start their companies, they've not been as gracious with their employee selection criteria.

What about the other holy grail? Going to vocational schools?

An Atlantic article digging into the piece explores how in the last two decades the enrolment in trade schools has almost doubled, comparable in size to traditional college. And for another key advantage, they tend to cost much less. According to one of the reports, the average cost of a technical college is $33,000 for the entire education, which makes it anywhere from 2x to 4x cheaper.

But price isn't everything. While traditional colleges have a 60.4% graduation rate, 2-year institutions average a 31.6% graduation rate, reducing its ROI a lot.

Also, I couldn't find multiple empirical studies here, but the JHU study also notes:

An interesting finding is that the cumulative earnings premium for college dropouts is notably higher than vocational degree holders.

Looks like there are no easy answers here either. While the rhetoric of "send everyone to trade schools" might sound good, doesn't seem to be the panacea it's made out to be.

Another alternative is of course where the large technology companies directly tie up with skill providers like On Deck or White Hat or others to train up their workers from the ground up. Google with its certification program is a leader in this space, and I would imagine that more will follow. But this still is a small niche strategy that very few are actually following, though that seems likely because of administrative reasons.

Overall, the research seems sufficiently complex and reasonably conclusive, with plenty more rabbit holes to dive into, but it definitely shows the world has changed. For me, all of the above together corresponds to:

There's still a large contingent of eligible population who do not have a college degree, though it's falling fast

The benefits of a college degree are still high, and they mostly have positive ROI as an investment

However this is dependent on the major you study, the college you go to, and the financial decisions you make

Even with this, there is significant underemployment amongst college grads

There's some evidence that this might get ameliorated over a period of a decade, but cohort data here is naturally older, and might not be applicable to the graduates of today who face a different job environment

Going to vocational/ trade school helps change the expenditure, but the delta in graduation rates makes it less of an even trade

So the "yes, definitely go to college" strategy has shifted to "sure, go if you like, but do other things to make yourself seem strong in the job market" strategy, i.e., the original strategy has decayed

A natural outcrop of the original strategy fraying is that we see a whole bunch of new ideas popping up to solve the "credential climbing" problem. In the next decade we might even see a few surviving enough that it becomes the default. Whether that’s portfolio construction or new sources remains to be seen. Perhaps that’s the new paradigm of education that everyone seems to be talking about!

Thought exercise: suppose we knew a priori that college made exactly zero impact on earnings, but that the top 10% of young people (in some metric that combines IQ and sociability) decided to go anyway. The data would show a premium to going to college, since it definitely pays to be in the top 10%. Employers would hire college grads since HR departments are lazy and they can offload measuring the metric to the universities at the students’ expense.

At some point the 80th percentile would realize that they can go to college and be treated by employers as if they were in the 90th percentile. They’d get more money than their peers who eschewed college because employers would be slow to catch on that they were pulling from a diluted talent pool. So eventually everybody in that percentile would go to college.

Then the same thing would eventually happen at the 70th percentile, then the 60th.

Two things would happen. One: employers whose sweet spot is the 50-60th percentile would start requiring college degrees for positions where it used to not be necessary. Two: employers whose sweet spot is the 90th percentile would need to figure out some other way to filter out those below that level.

It seems to me this is exactly what’s happening. All along the way you’d see a go-to-college premium in the data, even though none of the above requires that college actually improve the quality of its students—all you’d need is an initial situation where most of the elite decide to go to college. This would even be true even if you controlled for our IQ-sociability metric, since those in the “bubbling-under” decile who went to college would get paid as if they were one decile higher.

So what new signal can come along for the 90th percentile to disrupt this model and bring about a new equilibrium where college is less important? So far I think the replacement signal for a college degree is… an elite college degree. Ivies and flagship state schools. Which really muddies the waters when it comes to giving advice to youngsters. Though maybe that’s a feature and not a bug, since it will be the upper-level students who will be best able to navigate through the murk.

You also can’t keep going down through the ranks forever. At the 40th, 30th, 20th, you start running into people who would never be able to reasonably afford college, even if the signal boost would be useful.

Something has to give at some point. I suspect the answer is the standard average-is-over story: the elite schools gain even more prestige, the low-end schools compete on cost, and the middle gets squeezed out.