Simulating understanding

Why don't we use simulations more to understand how the world works?

I

Why aren't there more simulations in studying or understanding things that impact the society?

Biology has its hands full with simulations and modelling. There's a field of computational systems biology that aims to build efficient algorithms with the goal of computer modelling of biological systems. There was even projects that aimed to map the entire genetic code, and to map the whole brain to simulate how it works.

There seems to be limited equivalents in economics. There are games for sure like MarketSim, and games to educate students. But rarely to help educate the practitioners. There's Minsky but that is so far out of the mainstream that the page I found is on Sourceforge.

Maybe it can be argued that the stress tests that the Fed did, for instance, can be treated as a sort of simulation, insofar as it asks a few "what if" scenarios. But even to the untrained eye that seems far too underwhelming to be of large enough utility, either for education or edification. It's not the equivalent of aerodynamics modelling of rockets.

The closest equivalent to something cool here I saw was the MONIAC (Monetary National Income Analogue Computer), which also had the fantastic name of Financephalograph (please someone bring this back!), which was created in 1949. It represented the UK national economy through the flow of water around transparent tubes, and while it was designed for teaching it turned out to also be useful for economic simulations.

I know we don't need to necessarily create a hydraulic system to model the economy today, but it seems a waste to not do so. If only so that the causality of the model upon the world can be directly examined.

There are smaller scale models to be sure. For example the Urban-Brokings Tax Policy Center runs a large scale microsimulation model to estimate the US federal tax system. But they're woefully underused for either explanation or understanding within the wider universe.

Of course there is an AI economist being developed as we speak. Hopefully this will help us connect the black box of AI to the black box of tax policy implementation to come up with legible approaches. But until that day arrives when the light shines bright, why aren't there more?

II

Smart economists can reasonably argue, and many have, that simulations are difficult in as complex a system as the economy, and therefore the best we can do is to look at the elephant from multiple sides and hopefully come to a consensus about its shape.

The reason this seems to be an issue in the first place is because reading papers in this space is a joyous occasion that seesaws your belief about any topic back and forth until you hit some sort of a dampened-oscillation-state and settle somewhere. For instance, let's have a look at a few that talks about business dynamism and whether we're seeing less or more entrepreneurship today compared to before:

In this paper, we review the literature on declining business dynamism and its implications in the United States and propose a unifying theory to analyze the symptoms and the potential causes of this decline. We first highlight 10 pronounced stylized facts related to declining business dynamism documented in the literature and discuss some of the existing attempts to explain them. We then describe a theoretical framework of endogenous markups, innovation, and competition that can potentially speak to all of these facts jointly. We next explore some theoretical predictions of this framework, which are shaped by two interacting forces: a composition effect that determines the market concentration and an incentive effect that determines how firms respond to a given concentration in the economy. The results highlight that a decline in knowledge diffusion between frontier and laggard firms could be a significant driver of empirical trends observed in the data. This study emphasizes the potential of growth theory for the analysis of factors behind declining business dynamism and the need for further investigation in this direction.

Exhibit B - What’s Driving the Decline in the Firm Formation Rate? A Partial Explanation; Ian Hathaway, Ennsyte Economics Robert E. Litan, The Brookings Institution; Nov 2014

Slowing population growth in the West, Southwest, and Southeast regions since the early 1980s appears to be a major factor. Firm formation rates were highest in these regions in the late-1970s, when the data begin, and appear to be driven in no small part by expanding regional population growth in the preceding decade. When the rate of population growth in these regions began to decline, so did the rates of firm formation— declining most, on average, in these previously higher-growth regions.The relationship between regional population growth and firm formation rates is remarkably strong, even after controlling for other factors—including unobserved time and regional effects (such as industrial and labor market composition, culture, and potentially, public policies).

A second major factor is business consolidation—a measure of economic activity occurring in businesses with more than one establishment. In previous research, we documented a pervasive increase in business consolidation across geographies and sectors during the last few decades. Here, we are able to link it with declines in firm formation—especially after including time and region fixed-effects. We concede that the relationship between this measure and firm formation is hardly settled—clearly, a number of unobserved factors could affect both simultaneously or causality could partially run in the other direction. Still, we are confident that this finding is robust, and encourage other researchers to build on our work here.

Some have raised the possible link between declining shares of the population in prime-entrepreneurship age (35 to 44 years) and falling firm formation rates, but our analysis of this relationship comes to more ambiguous conclusions. On the one hand, we find that this group is associated with increases in firm formation. But, on the other hand, changes in this measure don’t correlate with changes in the firm formation rate during the period of its observed decline. So, while an increase in this portion of the population might be a boost to startups in the future, we don’t believe it played a role in the recent decline.

This paper studies the causes of the declining startup rate over the past three decades. The stability of firms’ lifecycle dynamics throughout this period along with the widespread nature of the declining startup rate place strong restrictions on potential explanations. We show that declines in the growth rate of the labor force explain an important share of the startup rate decline while leaving incumbent dynamics unaffected in a Hopenhayn-style firm dynamics model. Moreover, using cross-sectional demographic variation we estimate a quantitatively and statistically significant labor supply growth elasticity of the startup rate, which is robust to alternative specifications. Our findings suggest that the decline in the growth rate of the working age population through its general equilibrium effects on firm dynamics are an important driver of the decline in firm entry.

Exhibit D - "From Population Growth to Firm Demographics"; Hugo Hopenhayn, Julian Neira, Rish Singhania; Dec 2018

The US economy has undergone a number of puzzling changes in recent decades. Large firms now account for a greater share of economic activity, new firms are being created at a slower rate, and workers are getting paid a smaller share of GDP. This paper shows that changes in population growth provide a unified quantitative explanation for these long-term changes. The mechanism goes through firm entry rates. A decrease in population growth lowers firm entry rates, shifting the firm-age distribution towards older firms. Heterogeneity across firm age groups combined with an aging firm distribution replicates the observed trends. Micro data show that an aging firm distribution fully explains i) the concentration of employment in large firms, ii) and trends in average firm size and exit rates, key determinants of the firm entry rate. An aging firm distribution also explains the decline in labor’s share of GDP. In our model, older firms have lower labor shares because of lower overhead labor to employment ratios. Consistent with our mechanism, we find that the ratio of nonproduction workers to total employment has declined in the US.

We have a few different answers, to say the least, though C and D seem to agree on some of the major ones, and B puts couple of those conclusions such as increasing dynamism depending on population growth into question. The mechanisms they use are also different, which affects the conclusions you'd wish to draw. Which by itself is not a problem, though the fact that choosing amongst the few requires you to be an economics PhD and therefore argue with other PhDs until someone agrees with you seems slightly counterproductive. There's no source of truth where base assertions can be laid out, much less relied upon. For instance, when looked at in detail the difficulties in economics simulations include:

Even the smallest interactions within the overall system are not settled - there are multiple models of how consumers make purchasing decisions, how companies create products, how companies hire workers, how regulations work in a society, how taxes affect company and individual decisions, etc.

Empirical tests are fraught with the immense difficulties of measurement in social science and messiness of real life. Even when natural experiments make measurements possible, the number of confounding variables is too high.

To compare the output of a model to reality and see if it's accurate itself is an exercise in statistical sophistry making them, at best, a guide

III

What does the world look like in the biological world, which is a clear candidate for the extremely complex feedback loop laden world we live in?

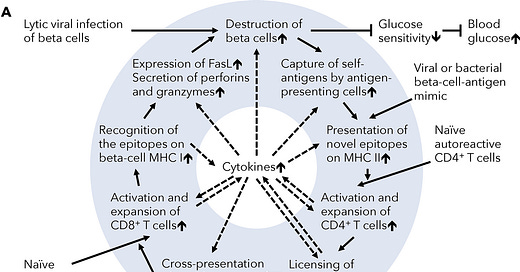

Turns out the studies there is awash in simulations and analyses of feedback loops. For instance, a short and tentative list of feedback loops that affects several age related illnesses in the human body.

There are similar ones for other diseases too, including atherosclerosis. The study summarises that the cycles are an example of how complex systems interact with each other.

This study showed that potential vicious cycles underlying ARDs are quite diverse and unique, triggered by diverse and unique factors that do not usually progress with age, thus casting doubts on the possibility of discovering the single molecular cause of aging and developing the single anti-aging pill. Rather, each disease appears to require an individual approach. However, it still cannot be excluded that some or all of these cycles are triggered by fundamental processes of aging, such as chronic inflammation (Franceschi and Campisi, 2014), accumulation of senescent cells (Childs et al., 2015; Yanai and Fraifeld, 2018), misregulated apoptosis (Tower, 2015), exhaustion of stem cell pool (Oh et al., 2014), shortening of telomeres (Blackburn et al., 2015), DNA damage (Moskalev et al., 2013; Vermeij et al., 2014), epigenetic changes (Brunet and Berger, 2014), activation of retrotransposons (Cardelli et al., 2016), intracellular garbage accumulation (Vilchez et al., 2014), mitochondrial ROS overproduction (Dai et al., 2014), dysregulation of intracellular signaling (Blagosklonny, 2014) or neuroendocrine dysfunction (Dilman and Dean, 1992; Gupta and Morley, 2014).

Just that list of "fundamental processes of aging" itself is enough to give one whiplash in its relative comprehensiveness on the one hand and sheer variety of impact vectors on the other. But I don't know about you, but this seems like a better way to understand the ways in which individual components affect each other and how the global system moves accordingly.

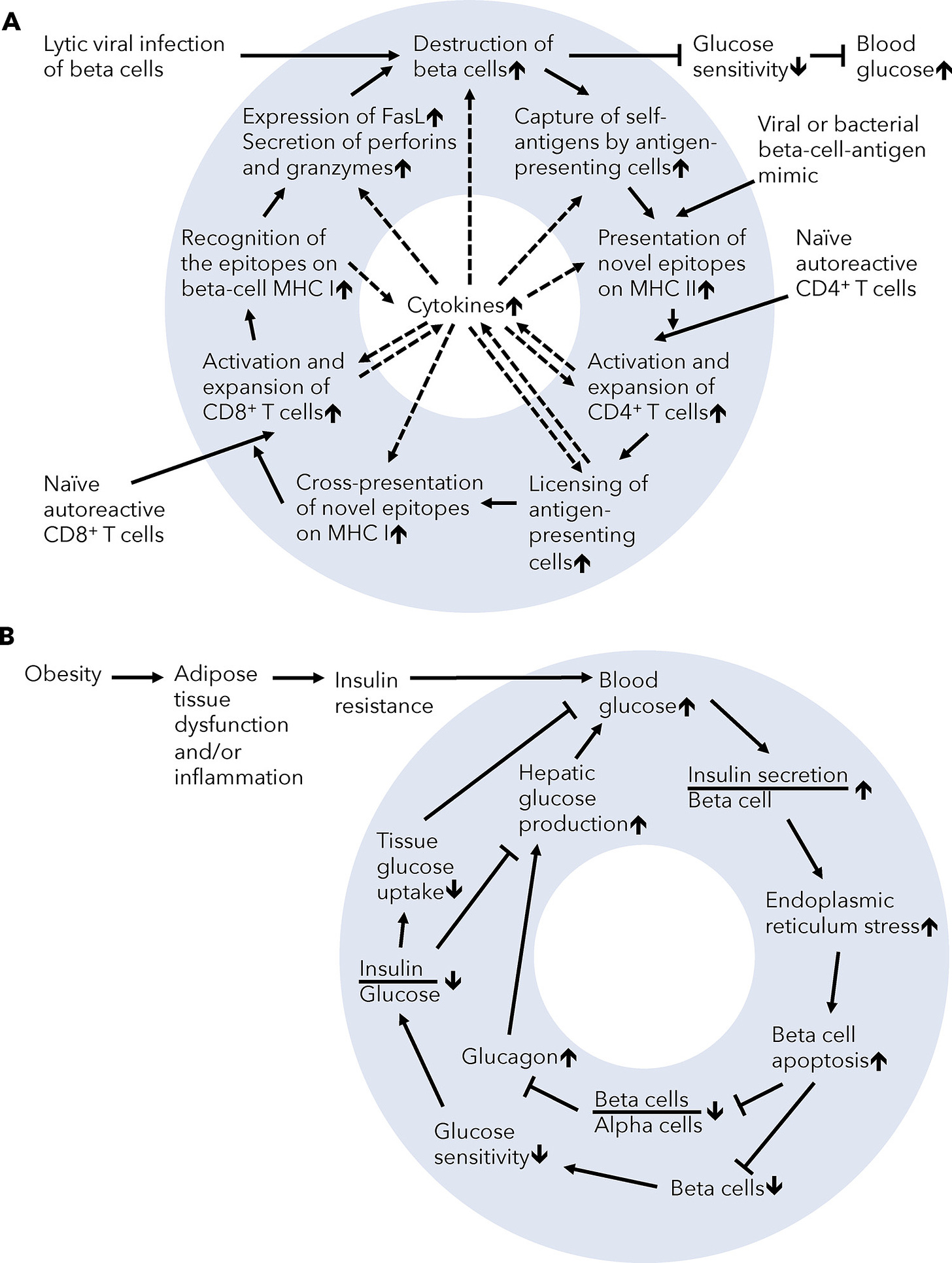

Similarly if you have a look at food web of Bear Island, it shows this:

The Blue Brain Project aims to entirely reconstruct the brain digitally. The aim here is staggeringly complex and the fact that they developed software to be able to do it itself is amazing. For instance, the BluePyOpt module to build electrical models of neurons is available on Github, as are all the other software modules they developed.

Apart from reaffirming everyone's faith that the Swiss are amazing, this is what scientific courage looks like.

There's a reason that Ray Dalio's "How the Economic Machine Works" is so popular. It's because it's understandable. Sacrificing false precision for legibility has its advantages and it feels odd that the pendulum has swung so far in one direction since the MONIAC.

IV

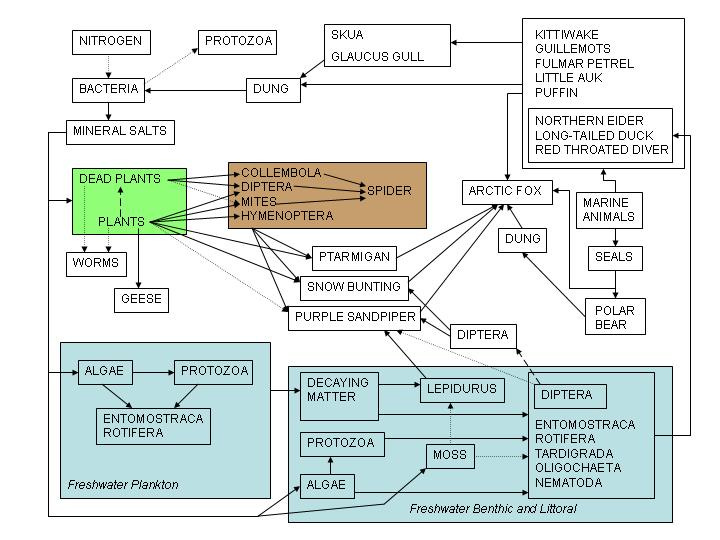

But here I feel like I've been arguing for a mirage. What would something like this even look like in the real world? To test whether this is even feasible, I knocked something together in AnyLogic. Excuse the ugliness, it was a 1-hour effort.

Annoyingly enough, I figured after I made it that sharing it is a pain in the ass. So to take this idea for a test drive, let's look how a normal intertemporal model actually could look like under a couple assumptions of wealth, education, jobs and consumption. All numbers are of course pretty random and the example simulation includes:

Wealth is distributed according to some power law

People get different education based on circumstances, which changes the types of jobs they can get

The situation pushes specific types of consumption - pushing demands for goods differentially

Some assets also change in price due to demand supply

This changes how wealth gets redistributed again in the next period and also causes change in consumption consequently

Those people then do different levels of education then to arm kids for the next temporal epoch

Some money disbursed back via government and raises capital which gets spent on social goods (health, social safety net, military, education), that helps everyone re maximising life value

And so on and on...

Naturally it's fairly basic, and doesn't include nearly the level of detail that a real model needs, but to me this is way more sensible than reading reams of equations about general equilibrium modelling in a specific corner of tax policy implementation. That's extraordinarily important but ignores the forest for the trees.

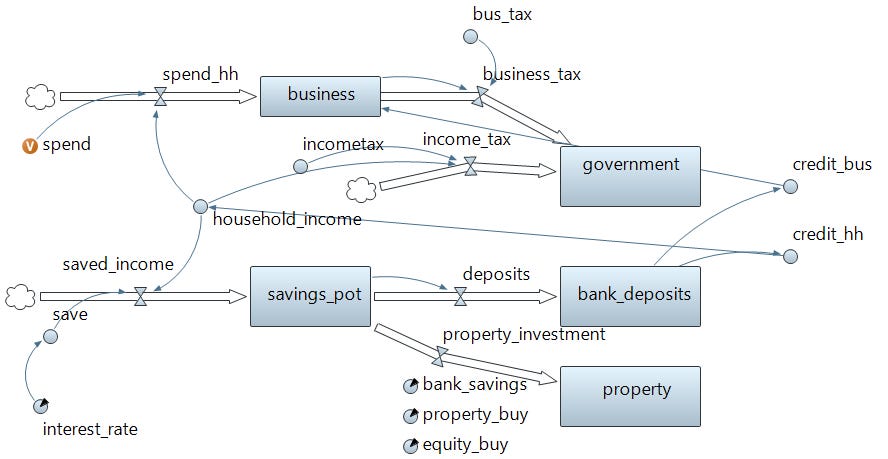

But it also showed me some key intuitions around how inequality might present itself. For instance, here's a quasi-Gini I cooked up, calculated as the average wealth divided by median wealth.

It's the introduction and interplay of the growth of wealth as related to income that's creating the delta here, and the introduction of a "society base" that's similar for everyone that keeps things on an even keel.

And most importantly, I hope I'm not alone that a pictorial representation of how things actually affect each other is pretty useful to understand a phenomenon. I'm sure that folks who've been economists for half a decade have these things seared into their minds, just like I have options trading and tech products seared into mine, but fortunately we don't just talk to other geeks who all happen to share the same interests. Legibility is important.

The problem with social sciences is not that it's not rigorous enough. There have been enough mathematical prodigies who have engaged with these subjects that this particular issue is no longer valid. Neither is the opposite, which is what I believed post graduate school. That sophistry in modelling had replaced understanding of the real world as its primary goal. To be sure, economics has its fair share of these, but I don't think that's the fundamental issue.

As one of the papers that questioned this practice argued:

We argue that true simulation is seldom practised because it does not fit the conception of understanding as analytical derivation from a set of fundamental economic axioms, which is inherent in mainstream economics.

The fundamental issue is that it deals with the collective decisions of people and these people have reasonably well thought out ideas, convictions and beliefs of their own. So your ability to create a narrative of being correct has to have a relief valve that makes it pass the normal barriers people would put up against these types of thought processes in the first place.

Put more simply, in the absence of clear feedback loops, it's harder to make the case that you're right just by using statistics. It shouldn't be the case. But it is. Because education about statistics is also one of those things that have never been done!

It's worth thinking whether the opposition to the very field is just a result of few kooks not understanding the sophisticated statistical analyses, or something else. After all nobody does this in physics. They have their flat earthers, but whatever you say about them they're not a particularly widespread group. Neither in biology, even in contentious things like vaccines.

With economics it's the very opacity of individual decisions that creates a problem. For every since "correct" idea that emerges there seems to be a ton of ideological and procedural objections. Some valid and mostly invalid as they may be, but the volume of them suggests that something is wrong in the ways we are approaching things.

Maybe it's a question about explanatory power vs predictive power. But then the group seems hopelessly naive with the latter and barely useful beyond the very basics to the former. For the latter we might as well get insights from hedge fund managers and venture capitalists. That would be like getting most medical insights from working doctors rather than medical researchers who run clinical trials.

Ultimately it feels like there's too much ideological resistance to the way the world is, rather than just methodological resistance to particular modes of analysis. There's fundamental disagreement often on how things work in the first place.

The thing is that there are two ways this could've been solved. One is to bring the public up to speed through non technical writings. Several blogs and a few freakonomics later, it's helped but not enough.

I'm not saying the goalposts have to be public conversion. But getting to a mutual understanding on some basic facts might be useful.

V

All of which brings me back to the crucial question. Why aren't there more simulations of how anything works to help explain it? You look at politics, each issue is dealt in isolation. You look at investments, each factor is either the most important or not mentioned. Watching CNBC is enough to make you want to stalk an anchor there and shake them till they spout nuance.

There needs to be at least a few simulations of parts of the economy that can help promote an understanding of how the world actually works. It sure would be useful when you're talking about the velocity of money, or the job landscapes becoming more fragmented, or capital becoming more borderless, or labour bargaining power decreasing, to see how they actually affect the world we live in.

For example when I started in the finance world post studying economics, I had a ton of hubris that I actually knew what everyone else was talking about. Turned out that was a mirage! And not just because of the gap between theory and practice. This was the gap between theory and theory. My very understanding was oftentimes shaky, and almost always incomplete.

I compared notes with a friend who went to medical school who had also confessed to feeling the same way. The difference was that he was often wrong in the response due to lack of real world information (what patients are likely to be taking) or speedy identification of the right thing to do. But not with respect to a fundamental understanding of the medicine itself. It wasn't because all of a sudden the patients all became unresponsive to pain medication and had to be hypnotised to perform surgery. It was because a perfect model rarely survives intact upon contact with reality.

Now it could very well be that everything I learnt and my estimate of my knowledge were both totally out of the mainstream whack. After all, economists and MBAs do love to tell everyone where they went to school, to cap the feeling that they won the race of life.

But shouldn't I at least know that what I learnt was in some way asterisked? If everything sounds the same and looks the same and passes the same empirical tests, how do you know whether you're actually getting knowledge or pseudo bullshit that's well camouflaged? How do we know we’re not looking at complex epicycles that purport to explain the planets?

And the latest shift into becoming more empirical only makes the discipline seem even more detached. Running feats of data analytic superstardom makes one closer to the chaps who optimise ad targeting at Google. Phenomenally hard work, but it's unclear it has substantially shifted the burden of actually understanding on what's actually going on. Empirical analyses can tell us a lot but it can only be situated within the questions we're smart enough to ask and conclusions we have a framework to hang things onto.

Chris Anderson predicted the end of theory in 2008. I hope to god that's not true, because if it is we're all just hamsters in a wheel now, running with no understanding as to why.

Maybe in the end social knowledge only comes in small dribbles and we're doomed to spent centuries running natural experiments and arguing with each other. If so especially it's important to actually help explain what we think about the workings of the world as a model that people can play with.

You could argue that it's only through rigorous analysis and deep and thorough understanding of a subject that the experts create their insights and therefore we should accept them more often than not. And we do. But in enough cases that analysis and understanding, though derived in a highly rigorous fashion, turns out to not be rigorous enough compared to the real world. We're all dependent on others to help build the superstructure of knowledge and push our collective understanding forward. Your assumptions become the most important aspect of the analysis, not your conclusions.

Epistemic understanding is dependent on our collective knowledge at the best of times. We always outsource part of our knowledge gathering and storage. That's kind of the whole human superpower, to not have to analyse and understand everything we do at an atomic level, so that I can just press the microwave button to warm up my milk without really knowing the difference between it and my WiFi (one's about 10^3x more powerful than the other). And when one breaks I call someone who knows a bit more about that particular device even though she'll also rather quickly get to a point where her knowledge ends and becomes dependent on someone else's expertise or our general collective wisdom.

That's the secret to our success. We live on stylised facts. Drawing a few boundaries of how this might affect other systems would surely be useful to see beyond our own circles of knowledge.

"Why aren't there more simulations in studying or understanding things that impact the society?" [especially economics]

Firstly, because economists' beliefs are wrong or not-even-wrong; second because the discipline of engineering simulation software is somewhere between incompetent and nonexistent.

Your post is important, I'm glad you restacked it recently, but it tries to deal with too much to comment on briefly. I'll just give some bullet points:

* Agent models have to have populations of agents which pay attention almost only to their own immediate economic concerns, not to aggregate statistics. The aggregates have to emerge from the decisions of the agents.

* The economy as a whole is the wrong place to start. Try something simpler, such as people trading a given currency pair, such as EUR / USD.

First, though, try hand-trading a practice account (e.g. Oanda using Metatrader 3 software). Give yourself 100,000 times more trading experience and discipline using automated algo-generation and testing software that lets you try all sorts of variations, for instance ForexStrategyBuilder (an old c. 2008-12 demo version is best. The web version has fatal drawbacks, and FSB Pro is expensive.).

You'll find this simplest of all markets still isn't simple at all, but the strategies that have a chance to work out-of-sample ARE very simple. (e.g. the ur-mean-reversion strategy: on a ranging (flat) 1 or 5 minute candle chart, sell the minimum broker-allowed amount each time the price crosses an upper "steady" indicator band, buy a minimum amount each time crossing the lower band, never close, no stops. Set the band spacing so that it trades between every 10-100 candles, it will automatically scale in and out of positions over a period of days or weeks.)

Model the effects on agent and market behavior of differing market rules in different jurisdictions, e.g different margin limits, actual interest rates, trading provider behaviors, regulators etc. Model the effects of different market participants using different strategies, including both psychologically-affected hand-trading and various algorithmic approaches. After tuning your simulation so it bears a decent resemblance to high-time-resolution market price- and depth-of-book data over modest intervals when there are no news shocks, expand the simulation to include effects from quantitative news events (economic numbers announcements and some other correlated major currency pairs, then other financial time series. This is still just a warm-up for simulating an economy.

* You'll want to get each of your agents to fit in a GPU core or at least a small block of cores to be able to run enough of them often enough. The time-steps have to be minutes. or at most an hour for a realistic economic simulation, daily won't do.

* Agents in the population can't all be alike, or even similar, whether in specific private data, types of data (some may not pay attention to most prices of things they have or want, others may watch every tick of many prices), models of their world (and most may have incorrect fundamental models, e.g. believing that banks loan out deposits), ways of making decisions (e.g. emotional, stochastic or algorithmic); ability to make correct decisions or, equivalently, the difficulty of problems which they can solve. (see my posts on Rasch measures of intelligence).

* Once you have such an agent-based simulation of a small number of financial time-series working to any useful degree, you'll be making too much money with it to even think of publishing it. This is why the literature of quantitative finance is usually of such low quality. The legendary Ed Thorp discovered the options pricing formula years before Black and Scholes, almost published, but didn't. (Any readers who don't know about him - it's worth looking Ed Thorp up. Math prof, invented the true market-neutral hedge fund, ~invented counting cards, invented the wearable computer with Claude Shannon to beat roulette, etc.)